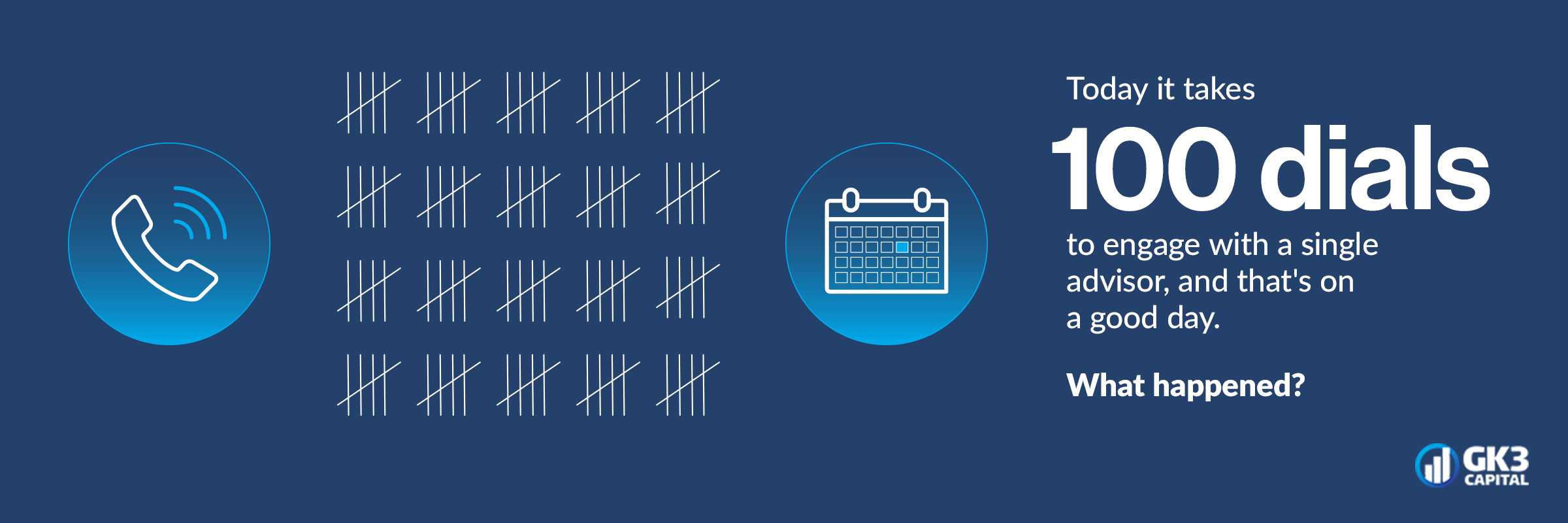

The Formula Is Broken: 100 dials to schedule an appointment

As an asset manager, you face many challenges: increasing competition, rising costs, shrinking fees, and margin compression. It's hard to raise new assets and difficult to retain them.

At the center of these challenges is an outmoded distribution model that worked ten years ago but no longer. Once, your internal wholesalers could make 50 dials, have meaningful conversations with five to ten advisors, and fill their external wholesalers' weekly calendars with appointments.

Now it takes 100 dials to engage with a single advisor, and that's on a good day. What happened?

The World Has Changed

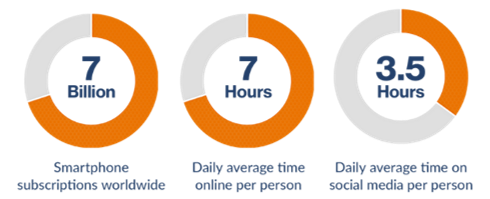

Quite simply, the world changed, and asset management distribution needs to change too. Today’s investors and consumers have all the information they need on the web and at their fingertips. As a result, you need to engage your future clients differently. You need to meet them where they are: online.

There are over seven billion smartphones worldwide. With all these screens, we collectively spend an increasing amount of time digitally engaged, currently an average of seven hours each day, with half of that on social media.

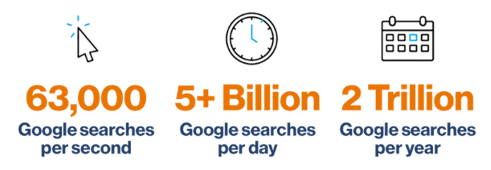

And what are we doing with all that time? We are searching for answers to our questions and solutions to meet our needs. There are over 63,000 Google searches every second, equal to over five billion searches each day and two trillion per year.

Who’s Got the Power?

Digital empowerment has completely changed how advisors and investors interact with your company. Investment and fund research begins with an anonymous online search or visit to your website. On average, advisors are 71% through the buying process before ever speaking with one of your wholesalers. That means most of the decision-making process has already been completed before a potential investor speaks with someone on your team.

"Today, relationships begin on the other side of a Google search,

If You’ve Bought a Car, You Understand

Sales in financial services can appear complex. A simple way to understand the evolution of how we make buying decisions today is to consider how the process of buying a car has changed.

Car Buying Before

Remember how you bought a car not long ago? You went from dealer to dealer on a Saturday or Sunday to test drive different models. The salesperson sat in the passenger seat. They pitched you on the features and benefits of that particular car, and its advantages over similar cars they knew you would also test drive.

After weeks of visiting dealerships and test driving different brands and models, you finally decided which car to buy. You returned to the “winning” dealer. The salesperson sat across from you at a desk. They wrote a number on a sheet of paper. They turned the paper over and said: “this is what the car will cost.” You then scrunched your nose and rubbed your forehead. You hemmed and hawed. You said no.

Next, the salesperson headed to the back office, where the sales manager had a magical calculator. The salesman returned with a new number – and the process continued. Yuck.

Car Buying Now

Today, when you buy a car, you do your research online. With YouTube, you watch other people test drive the vehicle. You read reviews, comparisons, and articles about which SUV or sedan is best. You can even build your car online.

You can complete the process digitally, or head back to the car dealer, this time with a printout of all the details on the car you built and are ready to buy. You hand that printout to the salesperson and say, "I know you've got this car. I know you have it in stock. I know you're selling it for 50 thousand dollars. If you give it to me for 48, I'll buy it today.” Done deal. You drive away happy.

Once, the power and control of the buying process resided with the product provider. Now the power resides with the buyer. The same dynamic applies to asset management with profound implications for your distribution strategy.

Adapting to a New Model

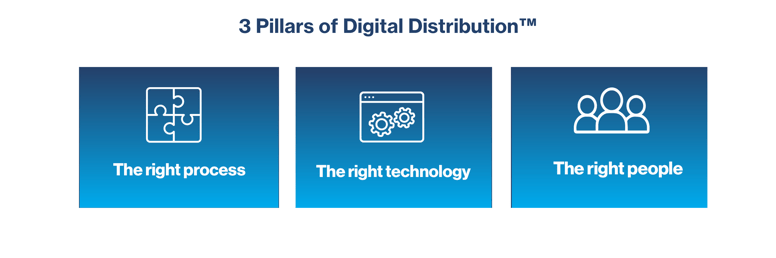

With most of the buying process now online, the traditional asset management sales model needs to evolve. Asset managers who understand that providing a digital-first experience will become the sponsors of choice. Fortunately, there’s a model for how to do that. We call it Digital Distribution™. Here's how it works:

Right Process

First, you need the right process. The process is called inbound sales and marketing. Simply stated, inbound is the roadmap for how to grow a business in a digital world. Inbound provides a step-by-step guide for the strategies and tactics you need to align with how buyers make decisions today.

Applying the inbound process, you educate your prospects with unbiased thought leadership on how to solve their problems, you facilitate their due diligence, and you earn their trust – online.

Right Technology

Second, you need the right technology for a truly effective digital wholesaling platform. The platform includes five key components: a dynamic CRM, robust data, a website engineered for lead generation and sales, marketing automation to nurture your growing set of relationships, and sales enablement to automate the closing process. With these tools, you’re on your way to building a revenue-generating machine.

Right Team

Third, you need the right team, which will look different than the sales and marketing teams of years past. You need to add digital experts who can: create content, start an online dialogue with advisors, provide a steady stream of qualified prospects to your sales team, help nurture potential client relationships, and automate the fundraising process.

In the digital era, internal salespeople will provide more technical assistance. And the best external salespeople will be consultants, helping clients find and implement investment solutions. The digital wholesaling team of the future will unite sales and marketing to increase revenues and serve clients like never before, both online and in person.

Moving Forward

With the right process, technology, and people, you're ready to move forward with today's digital distribution model. To learn how you can transform your distribution process, watch our video series How to Grow Your AUM with the Power of Digital Distribution™.

Topics: Digital Marketing Inbound Marketing Financial Services Marketing Digital Wholesaling Business Development Content is King Financial Services Marketing Automation Wholesalers Growth Driven Design

Stay in Touch

Subscribe to our email newsletter

Posts by Tag

- Business Development (25)

- Buyer Persona (12)

- Buyers Journey (5)

- Case Study (2)

- Content is King (25)

- Digital Marketing (75)

- Digital Wholesaling (36)

- Financial Services (19)

- Financial Services Marketing (57)

- Growth Driven Design (15)

- Inbound Marketing (75)

- Inbound vs. Outbound (10)

- Internal Wholesaler (2)

- Marketing Automation (18)

- Robo-Wholesaling (1)

- Sales (6)

- Sales Enablement (12)

- SEO (3)

- Wholesalers (18)