8 Doubts You Might Have About Digital Marketing in Financial Services

April 24th, 2024

3 min read

By John Gulino

Digital marketing strategies have inspired optimism, debate and discussion among marketing and sales professionals in asset management, wealth management, and fintech. “Digital” is critical in navigating today’s competitive landscape to attract and retain clients and assets.

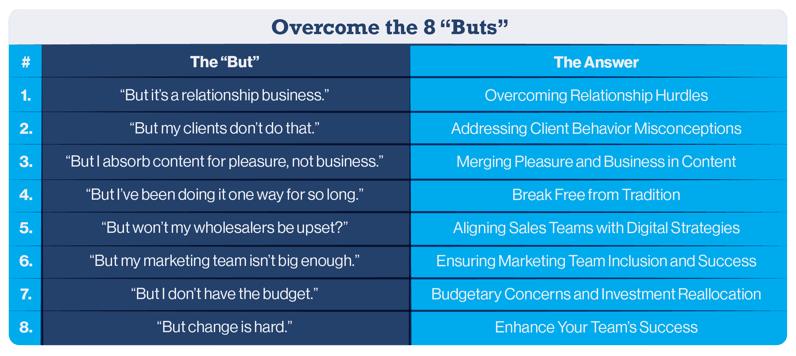

Yet, in many circles, this initial enthusiasm is followed by hesitation. "But" is a common retort. However, all those “buts” can hinder the growth. The “buts” stop progress, keep firms tethered to the status quo, and allow the competition to roar ahead.

Continue reading to learn how to overcome all those “buts” and achieve distribution success in our digital-first era.

“But” #1: Overcoming Relationship Hurdles

"But it’s a relationship business," they say. And they're right—it is. However, digital marketing isn't the nemesis of personal connection; it's the enabler. Through personalized email campaigns, social media interactions, and data-driven insights, digital tools can craft a richer, more individualized client journey, fortifying bonds rather than fraying them.

Enhanced by digital tools, relationships are strengthened, not replaced—through personalized communications and analytics-enhanced insights. Plus, digital systems like marketing automation and sales enablement infuse discipline and a repeatable process into investor engagement.

“But” #2: Addressing Client Behavior Misconceptions

"But my clients don’t do that," some argue, doubting their clients' digital engagement. The data debunks this misconception, as the numbers paint a different picture: the majority of investors use online research to make financial decisions. In fact, digital buying has become pervasive across industries since the pandemic. According to Gartner, “75% of B2B buyers prefer a rep-free sales experience.”

Digital is not the future—it's the present, and clients are already there, scrolling and clicking their way to investment decisions.

“But” #3: Merging Pleasure and Business in Content

"But I absorb content for pleasure, not business," you might hear. Financial content doesn't have to be dry. Enter the era of engaging, multi-media financial content. Investment firms are learning how to create dynamic content across multiple media, from eye-catching thought leadership to infographics, podcasts, and videos. By blending the informative with the engaging, you create content that not only captures attention but also educates and builds trust, creating a memorable investor experience.

“Digital content … disseminated across multiple channels and touchpoints will be critical for asset managers seeking to retain and grow mindshare among asset owners making investment decisions,” according to Cerulli Associates.

“But” #4: Break Free from Tradition

"But I’ve been doing it one way for so long," is a common refrain. Yet, markets are changing, client expectations are evolving, and sticking to the "old ways" can mean missing out on new growth.

Innovation doesn't mean abandoning proven strategies—it means building upon them with modern tools and techniques.

“But” #5: Aligning Sales Teams with Digital Strategies

"But won’t my wholesalers be upset?" Wholesalers can only benefit from digital's reach. By integrating digital analytics and CRMs, wholesalers gain insights into client needs and behaviors, enabling them to tailor their approach and strengthen their pitch. Plus, wholesalers get a greater number of qualified leads faster. Then, sales enablement can help automate and discipline the sales process leading to higher production (and incomes) for salespeople.

Digital-enabled salespeople can focus on their best prospects and most valuable activities. This is important as salespeople are among a firm’s most expensive resource. Digital can optimize the ROI on sales for the firm. A tech-enhanced wholesaler can generate more revenues and profits, optimizing results for the entire company.

“But” #6: Ensuring Marketing Team Inclusion and Success

"But my marketing team isn’t big enough," some worry. Digital marketing levels the playing field, providing tools and platforms that multiply the efforts of even the smallest teams. Automation, targeted campaigns, and digital analytics allow marketers to accomplish more with less.

Even lean marketing teams can deliver robust digital campaigns and measure their impact with precision. With greater access to investor data and the cost-effective assistance of the right agency, marketing teams can “punch above their weight” and move at the scale and power of larger firms.

In our digital-first world, marketing launches the journey of the online investor. Enhanced fundraising, and greater collaboration between marketing and sales, are the natural dynamics that should follow digital transformation.

“But” #7: Budgetary Concerns and Investment Reallocation

"But I don’t have the budget," is a familiar concern. Compared to traditional marketing, digital often presents a more cost-effective solution, with measurable ROI and the ability to adjust in real time.

"But we already invested millions in technology," others may say. It's not about spending more; it's about optimizing what you have. Leverage your current investments by integrating them with new, efficient digital marketing tools and strategies.

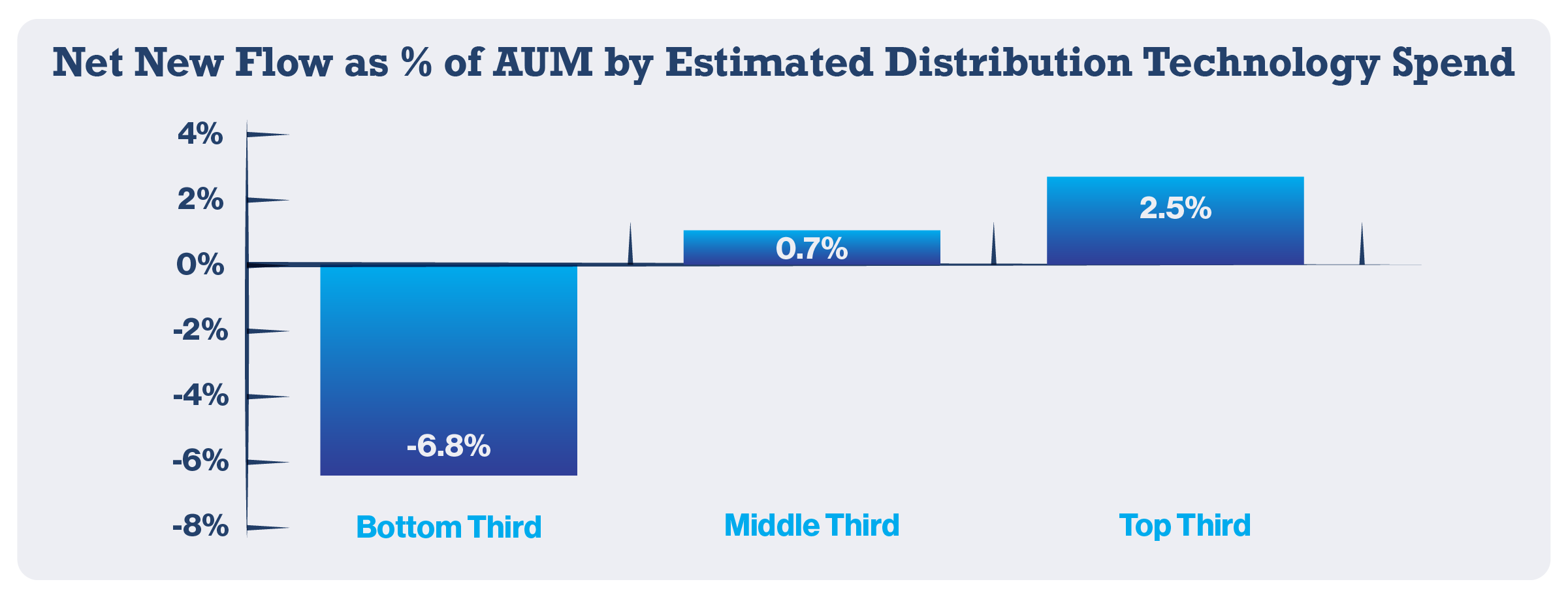

According to Deloitte, asset managers who lead their peers by investing in distribution technology see their assets grow. Asset managers who are stingy with distribution technology see assets shrink.

“But” #8: Enhance Your Team's Success

“But change is hard.” Treading water or staying in the same place is worse. Embracing digital tools is not just beneficial—it’s transformative. By doing so, you empower your sales team, enhance your marketing, and enable both to thrive in a digital-first environment.

Conclusion: The Digital Imperative

The shift to digital is not without its challenges, but it’s a strategic imperative. By addressing the “buts,” asset and wealth managers can move forward confidently.

Begin with a single step—optimize your website, engage on social platforms, upscale your content, or implement marketing automation. The digital landscape awaits, and so does the growth of your assets under management.

John Gulino is the Founder and CEO of GK3 Capital LLC. Experienced in all facets of distribution including management, direct sales, training, and development, John has been fortunate to represent some of the industry’s most respected and innovative financial institutions and has consulted with many more of the top asset management firms in the industry on how to better align their sales and marketing efforts.

Topics: