Digital Strategies to Prioritize Alongside SEO For Asset Managers

January 18th, 2023

8 min read

By John Gulino

We live in a “digital first” era. As a result, sales, marketing, and fundraising have completely changed for the asset management industry. And the pandemic only accelerated the velocity of change.

Forward-thinking asset managers now understand that their future growth and competitive viability depend on transforming distribution strategies to digital-centric models. Clients have moved online. Asset managers must also. Digital sales and marketing are about raising AUM, not getting on the first page of Google search results.

Where SEO Works Best (and Why Not for Asset Managers)

Search engine optimization (“SEO”) is a powerful tool in consumer marketing. For industries that cannot quickly and specifically identify a potential customer, SEO is critical. SEO enables marketers to attract potential customers searching for a product, service, or solution by connecting with them at their moment of keenest interest or intent.

For example, a consumer searches online for the best local store for a certain specialty. SEO enables businesses to participate in those searches with the right keywords for what they’re selling and what’s on their website. Properly executed SEO can place a vendor at the top of a search query. It's important to note a long-term SEO program requires sustained commitment and expense to be effective.

While SEO can be a valuable tool in driving traffic to a website and increasing visibility, it is not the only or most effective means of digital marketing available to asset managers.

How many allocators select the “best low-cost, low-beta large cap growth manager with low correlation to indices and high active share” based on a Google search? Research and due diligence are far more demanding and nuanced than that.

Moreover, the investment decision-making process is complex and may involve multiple stakeholders rather than a single individual making a purchase decision. In these cases, SEO may not be effective at driving flows. The target audience is not actively searching for the products or services in the same way that consumers might be.

Know Your Customer … Actually, You Do

One reason asset management firms may not need to rely on SEO is that they often have access to targeted data on potential clients.

Asset managers can acquire lists of the intermediaries or institutions they wish to reach, with contact information and comprehensive data on prospects’ investment preferences and activity. Regulations make sure that much of this data is public and disclosed. Commercial providers enhance the process.

Asset managers can further refine and sort the data to match their preferred investor persona and clearly defined audiences, and they can curate a list of prequalified investors highly interested in specific investment solutions.

A variety of providers do the work to facilitate access to this information. The key sources and providers listed below illustrate the data available to asset manager marketers.

.tmp$$.png?width=800&height=100&name=DRAFT%2014775%20GK3%20Blog%20SEO%20on%20the%20bottom%20of%20wish%20list_Providers.png%20(1).tmp$$.png)

Broker-Dealers, Custodians, and TAMP Platforms

An asset manager may sign a selling agreement with a broker-dealer or decide to pass due diligence with a TAMP or custody platform. The relationship often includes a list of advisors on that platform, their investment preferences, and contact information.

These lists provide asset managers with highly specific targeting opportunities. They enable asset managers to execute highly focused email and digital marketing campaigns.

Discovery Data

Discovery Data is a national leader for data on financial services professionals. The firm provides comprehensive info on financial services personnel, registered investment advisors and representatives, trust companies, broker-dealer representatives, and insurance agents.

Discovery Data is a national leader for data on financial services professionals. The firm provides comprehensive info on financial services personnel, registered investment advisors and representatives, trust companies, broker-dealer representatives, and insurance agents.

Working with data providers like Discovery Data, asset managers can customize and scale their digital outreach to fit their budgets and goals.

RIA Database

The RIA Database and RIA Channel provide comprehensive data, software, analytics, and marketing services to the financial services industry. The firm provides data on RIAs, broker-dealer personnel, bank and trust companies, and family offices.

The RIA Database and RIA Channel provide comprehensive data, software, analytics, and marketing services to the financial services industry. The firm provides data on RIAs, broker-dealer personnel, bank and trust companies, and family offices.

Dakota Marketplace

Dakota Marketplace offers up-to-date intelligence on manager preferences and searches within the professional allocator community, encompassing Institutions, intermediaries, and RIAs. It can be a great fit for asset managers seeking to reach research and due diligence analysts.

Preqin

Preqin is a leading provider of data on the world of alternative investments. Preqin collects data across the ecosystem of alternative funds and investors, including private equity and debt, real estate, infrastructure, natural resources, and hedge funds.

eVestment

eVestment, part of NASDAQ, offers a global database on institutional asset managers, investors, and consultants. Manager performance data is the foundation of the eVestment database which also includes institutional mandates and investor and consultant activity. Asset managers provide copious data to eVestment on their strategies and funds and can access institutional investor activity as well.

eVestment, part of NASDAQ, offers a global database on institutional asset managers, investors, and consultants. Manager performance data is the foundation of the eVestment database which also includes institutional mandates and investor and consultant activity. Asset managers provide copious data to eVestment on their strategies and funds and can access institutional investor activity as well.

Data: Top of Your Digital Wish List

If asset managers could have a digital wish list, data would be at the top, as reflected by the copious sources and choices above. But what are the right next steps? How can asset managers drive profitable results from their data investment?

Capitalize on Data

Acquiring the right data comes first. The next step is capitalizing on the data. A spectrum of digital strategies can be used to convert data into new clients and increase AUM:

- Website Optimization

- Email Marketing

- Social Media Marketing

- Digital Advertising

- SEO and SEM (yes, search is still part of the toolkit)

Website Optimization: Engineering for Traffic, Conversions, and Signals

If data is at the top of your digital wish list, the hub of your digital strategy is your website. For asset managers, an effective website should be engineered to grow: 1) traffic, 2) conversions and 3) signals. Otherwise, your website is just an online brochure.

Your website should provide fresh content that keeps visitors returning for more. An effective website will enhance the potential revenue yield from your growing repository of data on prospective clients. The return on your investment in data compounds through the following steps:

- Traffic - You need to regularly drive traffic to your website. Use the rich data sets above for ongoing outreach to your ideal potential investors. Digital outreach can include email campaigns or list matching on LinkedIn or other social media platforms. Use the data to drive traffic. Then, fine-tune what works best to continuously drive traffic growth.

- Conversions - Next, you need to convert website visitors into prospects. A great customer-focused website inspires visitors to swap their contact information in exchange for your insightful content and solutions. Engineer these “conversions” in advance to turn your website into a lead-generating machine for your sales team. Conversions are a key step in converting data into AUM and revenues.

- Signals - Ultimately, as visitors engage with your website and your content, their online activity will provide “signals” to your sales team, like when an advisor downloads a due diligence questionnaire. Effective marketing and sales operations will establish systems that automatically follow up on signals from prospects and facilitate outreach from the sales team. Furthermore, the signals become an integral part of your growing data set.

Email: Reach Your Target Audience Directly

Email enables you to reach your target audience, investors, and subscribers directly but you must create emails that recipients want to open and act upon. Two key metrics reveal the effectiveness of your email marketing:

- Open Rate - When we scan our email inboxes, we make snap decisions as to whether to open and read an email. We unconsciously seek to say “no” to save time. Make sure your email appears personally valuable so your valuable content gets read. Carefully draft and test your email subject lines (and pre-header text) to maximize results.

- Click-Through-Rate (CTR) - After a recipient opens an email, does the message resonate? Is the reader inspired to take action? Does the body of the email offer information or a next step to help the reader reach a goal or solve a problem? Does the prospective investor click through for more info, sign up for a webinar or research, or to set an appointment? The click-through rate reveals the effectiveness of your emails.

By using email marketing metrics such as open rates and click-through rates, you can optimize the return on your data investment.

Social Media Marketing

The statistics below highlight the importance of social media in financial services:

- 1.5+ billion people worldwide use social media, according to McKinsey.

- 98% of investors use LinkedIn or Twitter every week to help with investment decisions, according to Forbes.

- 86% of investors consult a company or an executive’s social media channels when evaluating prospective investments.

How important is social media in financial services? Just ask Goldman Sachs about their 1 million followers on Twitter.

Asset managers can use data to enhance their marketing through social media, with multiple opportunities for synergy. For example, you can cross-reference your data to LinkedIn user names to target your specific audience, thereby expanding your outreach to such contacts across multiple channels, from email to social media and more.

LinkedIn to Engage Professional Allocators

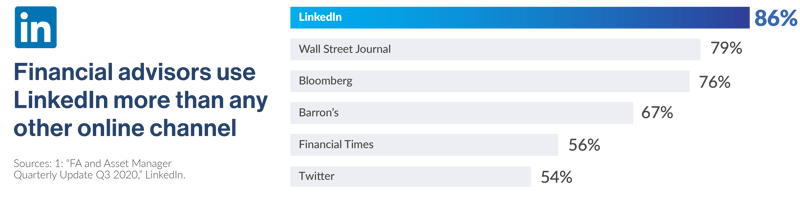

LinkedIn is the world’s largest professional social network, with over 185 million users in the US and 875 million users worldwide. LinkedIn is recognized for its lead generation potential and the wide variety of financial and investment content.

Financial advisors use LinkedIn more than any other online social channel and more than the Wall Street Journal, Bloomberg, Barron’s, and The Financial Times.

Asset managers use LinkedIn to distribute their content and thought leadership and to promote events such as webinars and conferences. You can also advertise on LinkedIn, using your data to improve your ROI.

Asset managers use LinkedIn to distribute their content and thought leadership and to promote events such as webinars and conferences. You can also advertise on LinkedIn, using your data to improve your ROI.

Two key data-driven approaches to advertising on LinkedIn enable you to focus on your key potential investors and optimize results:

- Cross-reference - You can cross-reference names in your database to names on LinkedIn to directly reach prospects. On average, we find 60% of the names in databases can be cross-referenced to LinkedIn. This gives you additional opportunities for regular exposure to key prospects.

- Demographics - You can use LinkedIn demographics like job title, firm name, industry, etc. to focus on your target audience, broadening your reach to prospects who fit your preferred profile. You can use similar approaches when you expand your outreach to other social media platforms such as Facebook or Twitter.

You will need to make sure your compliance, recordkeeping, and technology infrastructure and procedures are in place and robust for your social media marketing efforts since regulators generally consider such communications to be advertising.

Digital Advertising: Further Grow Your Audience With Data

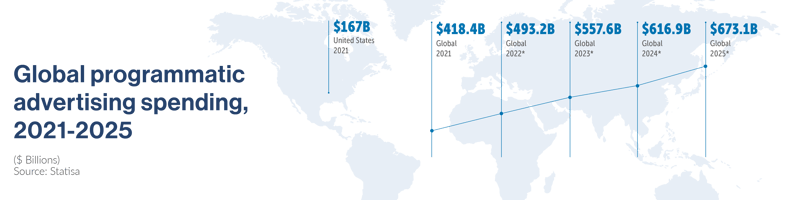

Digital advertising can dramatically broaden your reach. Digital advertising is forecasted to be a $600+ billion marketplace by 2025.

Nearly 90% of digital display ad spending is “programmatic.” Programmatic is the leading approach to digital advertising outside of social media platforms. In programmatic advertising, practitioners use centralized platforms to bid on ad inventories in real-time across the web, using algorithms and testing to reduce costs and optimize results. You can adjust ads, marketing approaches, and media choices based on real-time results.

Nearly 90% of digital display ad spending is “programmatic.” Programmatic is the leading approach to digital advertising outside of social media platforms. In programmatic advertising, practitioners use centralized platforms to bid on ad inventories in real-time across the web, using algorithms and testing to reduce costs and optimize results. You can adjust ads, marketing approaches, and media choices based on real-time results.

The most productive programmatic advertising campaigns are data-driven and further capitalize on your database in three potential ways:

- Matched Audience - Match names to your CRM.

- Lookalike Audience - Reach people similar to your customers or website visitors.

- Demographic Targeting - Target by geography, age, gender, company, job title, or interests

Further, you can utilize “retargeting” or ad placement focusing on users who have already interacted with your website or content.

SEO and SEM: When to Use

We have explored the importance of data in asset management marketing and the various approaches to harnessing data to optimize your fundraising.

While asset managers can tap a variety of strategies in their digital sales and marketing, SEO and SEM can still have a role. In the world of search, there are two primary approaches:

- Organic Search (free) - Search Engine Optimization (SEO)

- Paid Search - Search Engine Marketing (SEM)

The goal of SEO and SEM is to get your content to the top of a Search Engine Results Page (SERP) since most users stop at the first page of search results.

Some potential clients search for answers or resources online by typing keywords, keyphrases, and questions into their search engine. You need to align your content with these queries, an important part of making your SEO and SEM a success.

Financial Advisers vs. Asset Managers

Search may play a different role in your digital promotion activities depending on the nature of your business. For example, financial advisers are more likely to look for prospects they don’t know or have never met. An adviser specializing in tax-advantaged real estate strategies may want to optimize their content for investors searching for:

This financial advisor may benefit from SEO and SEM by targeting these keywords and topics to attract prospective clients to their content and website.

In contrast, asset managers are better equipped to utilize lists and data on the intermediaries or institutions they wish to reach and who are less likely to use search engines to research investment opportunities.

For Asset Managers, Data and Other Digital Strategies Come First

In summary, it's important to remember that SEO is just one piece of the larger digital marketing puzzle. Asset management firms should start with data as part of a holistic approach to digital marketing and then use that data as a foundation for a variety of digital strategies to reach and engage their target audience and grow their AUM and revenues.

Learn More

To learn how to enhance your fundraising process in our “digital first” era, download our FREE ebook: “Asset Managers Guide to Digital Digital Distribution” or watch our short video series: “Digital Distribution for Asset Managers"

John Gulino is the Founder and CEO of GK3 Capital LLC. Experienced in all facets of distribution including management, direct sales, training, and development, John has been fortunate to represent some of the industry’s most respected and innovative financial institutions and has consulted with many more of the top asset management firms in the industry on how to better align their sales and marketing efforts.

Topics: