In today’s digital-first world, advisors spend more and more time online searching for answers and investment solutions for their clients. As a result, asset managers need to rethink their sales and marketing strategies. Traditional wholesaling models have become less effective and more expensive than ever before.

Today, firms need to embrace a digital strategy known as Inbound to succeed in the competitive world of asset management distribution. Inbound is a sales and marketing strategy that aligns with how advisors make buying decisions today. Inbound enables you to gain the attention of your future clients, earn their trust, and motivate them to invest with you.

What is Inbound?

Before we discuss what Inbound is, it's essential to discuss what Inbound is not. First, Inbound is not a passive approach where your distribution team sits back and waits for advisors to come to you (often what people think when they hear the word Inbound). Also, Inbound is not the opposite of outbound. In fact, the two strategies are inextricably linked. Inbound simply makes outbound tactics more effective.

Inbound is an active framework that includes all the tactics and strategies needed to align with the digital buying processes of today–including that outbound call to a prospect. Following an Inbound strategy, that outbound dial is most timely when the prospect has provided digital signals of their interest in your firm or investments.

Perhaps the prospect downloaded multiple sets of materials from your site over the last several weeks. Or they signed up for one of your webinars. Or viewed your due diligence room today. These actions are digital signals for you to take prompt action and advance the relationship.

When viewed this way, the outbound dial is part of an Inbound strategy that created and nurtured advisor interest and cued your sales team for next steps.

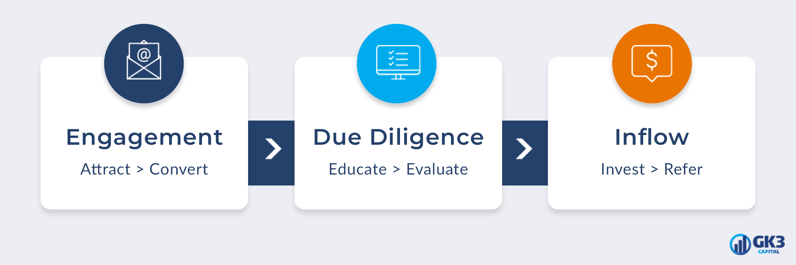

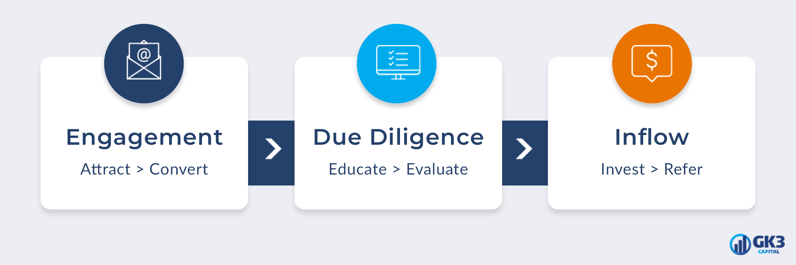

Three Phases of Inbound

1. Engagement Phase

The goal of the engagement phase is to attract your future clients digitally and start an online conversation. You demonstrate you understand their problem or need, preview your potential solutions, and offer materials to help educate them. Once engaged, you convert the prospect into a lead when they exchange their contact details for additional information or a call or meeting request.

2. Due Diligence Phase

Once converted, the due diligence phase begins. The due diligence phase starts with education. You teach your future clients how to solve their problems before fully engaging them with your solution. As a trusted educator, you make it easy for them to evaluate the specific products and services they might consider, including yours.

The next step is to provide the materials and tools for the advisor to complete their due diligence on your investment offering. You help them determine if your investments and strategies are a good fit or solution to their problem.

3. Inflow Phase

If you earn your future client's trust, you have entered the third and final phase, the inflow phase, where the client invests with you. At the start of the inflow phase, it's your job to make investing easy, such as with user-friendly online subscriptions.

Once a client invests, your mission is to ensure they have a great ongoing client experience, so you retain their assets. Provide informative, engaging, and easy-to-read updates on your funds and strategies and in-depth communications in both good and challenging times. Enhance your client relationship with thought leadership, insights, and practical tools.

Your success in the inflow stage may lead to additional allocations or commitments to other funds or strategies you offer. The ultimate success in the inflow phase is when your client becomes your advocate and refers like-minded colleagues and additional business.

Rewards Await for Those Who Embrace Inbound

This three-phased process may look straightforward. However, Inbound success requires fresh thinking and new resources when transitioning from a traditional asset management distribution model. You'll also need commitment from your most senior sales and marketing leaders.

Designing and implementing an Inbound strategy for your firm is not only worth the effort, but essential to accelerate your growth online with digitally-informed and empowered advisors.

Discover more about the Inbound strategy as the future of distribution, watch our Digital Distribution™ video series.

John Gulino

John Gulino is the Founder and CEO of GK3 Capital LLC. Experienced in all facets of distribution including management, direct sales, training, and development, John has been fortunate to represent some of the industry’s most respected and innovative financial institutions and has consulted with many more of the top asset management firms in the industry on how to better align their sales and marketing efforts.