Even the most valued, inspiring content won’t mean anything if it’s not compliant. Compliance is critical to operating lawfully across the highly regulated financial services industry. This blog highlights how you can help ensure your content always COMPLIES.

Step 6: Comply

Our approach is to partner with your compliance professionals to make sure your content meets industry standards as well as the specific standards established by your firm.

Do it the Right Way, First

Falling out of Compliance can be costly, triggering regulatory scrutiny, delays, oversights, violations, and even fines or the cancellation of your offering. A compliant approach to communications leads to better and more profitable outcomes. Compliance pays.

Old-Fashioned Standards of Rectitude

The world has become steadily more complex. New investment instruments have been created. Technology has transformed how we invest and communicate. Globalization means firms operating in multiple countries must comply with laws and regulations across diverse jurisdictions.

To meet the steady expansion of compliance obligations, some large organizations are even using the latest in artificial intelligence in high-volume content compliance reviews. Technology may be a compliance tool, nevertheless, sound human judgment remains the foundation for remaining within the bounds of the rules and regulations governing finance and capital markets.

Fair and Balanced

Compliance starts with integrity and common sense. As a principle, make sure that your content is fair and balanced. “Fair and balanced” is what we learned on the playground and at school.

Compliance is similar, except we must also apply specific rules and regulations. In fact, “fair and balanced” is a requirement of both the new SEC Marketing Rule and the longstanding FINRA communications and advertising rules.

Which Regulations Apply to Your Content?

As you build out your compliance program, you must determine which rules apply to you. The applicable rules will vary depending on the nature of your business or your offerings.

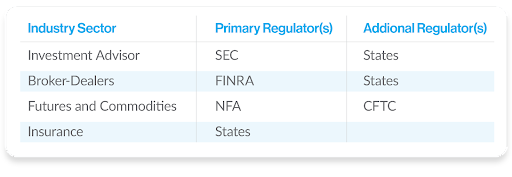

First, the nature of your business determines your key regulators and regulatory environments:

The nature of your services or offering also determines which regulations are applicable to your business:

Each of the above services, offerings, and products must comply with their applicable regulations. The compliance component of your content development process will vary depending on which laws and regulations apply to you.

Affirmative and Negative Regulations

The Securities and Exchange Commission recently implemented a total overhaul and modernization of marketing and advertising regulation. With the issuance of the new Marketing Rule, the SEC replaced a patchwork of instructions and no-action letters.

The new SEC Marketing Rule includes seven general prohibitions. Under the new rule, investment advisers may not circulate any advertisement that:

- 1. Includes untrue statements and omissions;

- 2. Includes unsubstantiated material statements of fact;

- 3. Includes untrue or misleading implications or inferences;

- 4. Fails to provide fair and balanced treatment of material risks or material limitations;

- 5. Fails to present specific investment advice in a fair and balanced manner;

- 6. Cherry-picks performance results or otherwise presents performance in a manner that is not fair and balanced; or

- 7. Is materially misleading.

Content creators for investment advisors must be diligent in adhering to these guidelines.

When Good Words Aren’t Good

The prohibitions above have broad application. As a result, content creators and writers must avoid self-promotion and excessive language. Superlatives you should avoid:

Why? Each of these words is a claim or statement of purported fact. However, claims must be substantiated. Otherwise, they are deemed to be misleading. If you make a claim, you must satisfy the question: “says who?” Otherwise, examiners will ask, “says who?” when they arrive at your compliance office and review your content.

If (or when) your strategy faces a challenging period, all your superlatives may be deemed false. Compliance-sensitive content creators avoid using superlatives.

Principles-Based vs. Rules-Based

The SEC adviser compliance framework is principles-based, reflecting the wide variety of advisory services covered. In contrast, FINRA rules, which govern broker-dealers and the sale of securities, are rules-based.

FINRA Rule 2210 establishes clear content standards:

(A) All member communications must be based on principles of fair dealing and good faith, must be fair and balanced, and must provide a sound basis for evaluating the facts in regard to any particular security or type of security... No member may omit any material fact or qualification if the omission ... would cause the communications to be misleading.

(B) No member may make any false, exaggerated, unwarranted, promissory, or misleading statement or claim in any communication.

FINRA rules further distinguish between institutional and retail investors. Content guidelines differ depending on the sophistication of the audience and the nature of the securities offered.

FINRA rules also have extensive filing requirements for content and advertising used for public offerings and solicitations. Content professionals must file their materials on a timely basis and in the required format. FINRA may request revisions.

Allow for Extra Time

Compliance reviews are an important part of the content creation process across the financial services industry. At GK3 Capital, we include extra time in our content calendars and process to allow for thorough compliance reviews and any necessary revisions.

Compliance and Content Best Practices

Compliance is integral to content creation for investment organizations. Best practices include:

- 1. Determine the applicable regulations

- 2. Incorporate compliance throughout the content development process

- 3. Allow sufficient time for independent compliance review and required revisions

- 4. Train your content team on the latest compliance developments

Conclusion

Compliance and marketing professionals are often viewed as two adversaries forever struggling to reach a mutual agreement. Our GK3 team believes the groups are actually partners, working together to ensure that quality, impactful content is also fair and balanced, and compliant with all regulations. By uniting compliance and content, you can grow your business effectively while adhering to industry standards.

Our next blog post highlights the importance of promoting your content once it has been created and approved by compliance.

John Gulino is the Founder and CEO of GK3 Capital LLC. Experienced in all facets of distribution including management, direct sales, training, and development, John has been fortunate to represent some of the industry’s most respected and innovative financial institutions and has consulted with many more of the top asset management firms in the industry on how to better align their sales and marketing efforts.

Topics: