How Outsourced Digital Marketing Boosts Wealth Management Growth

October 12th, 2022

3 min read

By John Gulino

Wealth managers and asset managers often reach out to us as they explore digital approaches to growing their business. A few years ago, one of our long-time clients referred a successful independent advisor in California our way.

The advisor had built a thriving practice. He provided comprehensive wealth and financial planning, specializing in tax-efficient investing and tax-advantaged real estate. In the past, he used seminars, TV appearances, and referrals for marketing. Nevertheless, he wanted to accelerate growth and take his practice to the next level. But how? That’s when he reached out to our firm, GK3 Capital, as a potential resource for digital sales and marketing.

The Challenge

This advisor was no stranger to technology. For years, he used educational videos to stay in front of clients and reach new prospects. He knew from personal experience the power of digital engagement. Yet, he was aware his small marketing team didn’t have the bandwidth to build and execute a true digital outreach program that would allow him to tap into markets statewide and nationally.

Outsourcing a targeted digital marketing program appeared to be the best approach, so he evaluated several agencies, large and small. He ultimately selected our firm, GK3 Capital. We specialize in digital growth strategies and solutions for companies in financial services. We’re an award-winning firm that helps clients raise capital more effectively. The advisor decided to leverage our team of seasoned investment professionals and digital experts. He believed we had the experience and skills to quickly get his marketing program up and running.

A Customized Plan

We started by developing a customized marketing plan highlighting the advisor’s expertise: tax planning and tax-favored real estate. The campaign focused on 1031 exchanges and Opportunity Zone investments and was built strategically, in phases.

Phase 1. Engineer the Advisor’s Website for Sales

Our team at GK3 Capital retooled the advisor's once static website. The upgraded site could track visitors, detail their interests, and provide answers to their most pressing tax and investment questions. Most importantly, we restructured the site to generate conversions.

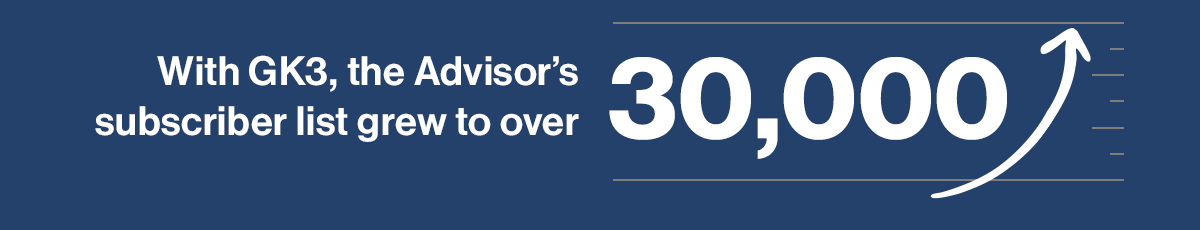

Conversions occur when a prospective client is willing to swap personal contact information in return for a valuable offer, like an educational ebook. With the conversion mechanisms in place, this advisor’s list of interested investors became a fast-growing email list.

Phase 2. Create a Content Arsenal

Our next step was to work closely with the advisor and his team to identify the:

- Topics prospects are most interested in

- Most frequent questions prospects ask about tax-efficient real estate investing

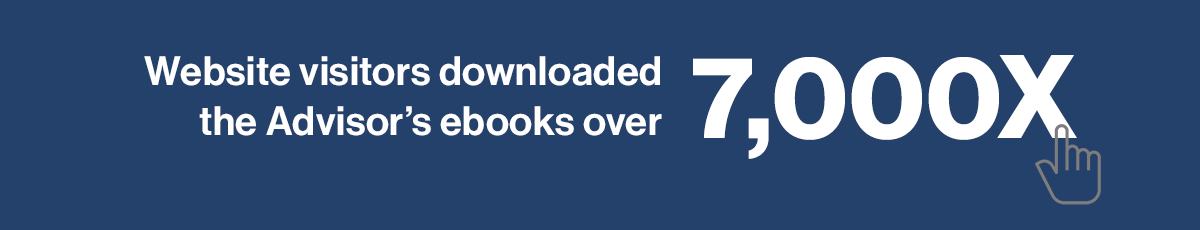

With that information, we began creating insightful content, including blogs, eBooks, online seminars, and social media posts that specifically addressed the most common concerns of prospective clients.

Phase 3. Apply Digital Engagement Strategies

The third phase of the marketing plan called for GK3 to implement diverse digital strategies to increase website visits by qualified investors. Key tactics included:

- Search Engine Marketing (SEM)

- Search Engine Optimization (SEO)

- Paid Digital Advertising

We use these strategies to attract prospects searching for answers online. So, for example, when an investor searches for something like, “How do I shelter taxable gains?”, the advisor’s site would rank highly in search engines. And for this advisor, that high ranking made his site a leading destination for tax-sensitive high-net-worth investors.

Phase 4. Automate the Process

The final stage of the custom digital marketing strategy that we created for the advisor required installing automations to help convert the growing volume of website visitors into clients:

- Marketing automation included lead scoring that identified the most engaged prospects and ensured they received systematic communications

- Sales enablement tools made sure the advisor and his team followed clearly defined steps to convert prospects into new clients

- Reporting tools provided real-time updates to the advisor throughout every project phase

Eye-Opening Results

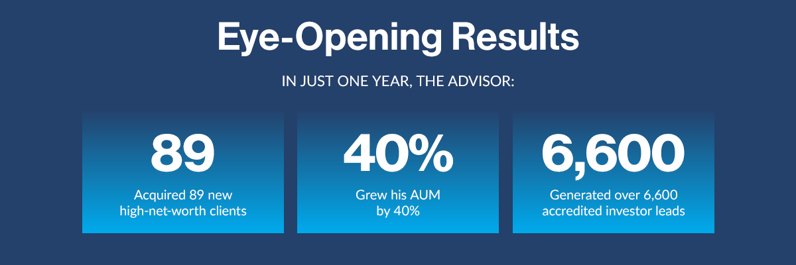

The advisor’s digital marketing program with us was a success. In just one year, the advisor:

- ACQUIRED 89 new high-net-worth clients

- GREW his AUM by 40%

- GENERATED over 6,600 accredited investor leads

Working closely with an advisor committed to online growth, GK3 Capital notched yet another digital marketing success. And for this advisor, our partnership confirmed his original belief that outsourcing was the most cost-effective and efficient approach. The advisor was so pleased that he expanded his ongoing engagement with us.

Consider Outsourcing Your Digital Marketing

While some asset managers prefer to have their own internal teams managing digital marketing, there is a growing trend to outsource these efforts. Firms operating in the highly regulated financial services industry should also recognize not all marketing agencies are created equal.

From correctly positioning investment products and services to understanding complex compliance and regulatory requirements, there are significant benefits to choosing a firm that specializes in working with wealth managers and asset managers.

John Gulino is the Founder and CEO of GK3 Capital LLC. Experienced in all facets of distribution including management, direct sales, training, and development, John has been fortunate to represent some of the industry’s most respected and innovative financial institutions and has consulted with many more of the top asset management firms in the industry on how to better align their sales and marketing efforts.

Topics: