.png?width=589&height=393&name=How%20a%20Leading%20Fund%20Sponsor%20Cracked%20the%20RIA%20Market%20And%20Raised%20$350M%20(TO%20START).png)

Early in 2020, the pandemic began to sweep the US. We received a call from a long-time client, one of the nation’s largest commercial real estate fund sponsors. Despite the headwinds, they wanted to keep moving forward. They wanted to build a new distribution platform to expand into the RIA channel, but how? The obstacles were many.

Amidst the Disruption of Distribution

The disruption of traditional distribution approaches for asset managers was already underway even before Covid. Investors were moving online. Old sales approaches weren’t working. Advisors were taking fewer phone calls or meetings.

Against this backdrop, our client asked us to develop and launch a new effort to penetrate the RIA channel. They had a legacy of great success in the independent broker-dealer market, raising over $1 billion each year with a classic wholesaler model. Now, they wanted us to join them on a quest to crack the RIA market. But the world was changing fast. Our client looked to us for a new approach.

A New Channel and Uncharted Waters

We faced a spectrum of challenges. We needed to help our client overcome three major obstacles to succeed:

1. Limited Access to Advisors

The virus had put the kibosh on in-person meetings. The increasing volume of phone calls to advisors was not productive. Wholesaler calls were going straight to voice mail. Few asset managers were having meaningful conversations with advisors. The pandemic was accelerating the disruption already underway for the old-fashioned asset management distribution model.

2. The Move to Online Due Diligence

RIAs are notoriously difficult for asset managers to reach. The new work-from-home environment only exacerbated this. Advisors were pursuing more and more of their research online. For the new generation of due diligence analysts, the transition to online research was natural for them as digital natives. Seasoned RIAs and research veterans emulated their junior counterparts when they discovered the efficiency of online fund and manager research. This evolution raised questions about the future role for fund wholesalers. Asset management sales professionals had to find new ways to provide value. Learning how to log on to Zoom was not enough.

3. Resource Constraints

The client was still enjoying success raising capital in the broker-dealer channel. Understandably, they did not want to divert resources or focus from those efforts. Our client also had little interest in adding headcount to a sales team grounded amidst a pandemic. They realized they needed a highly skilled digital marketing team to partner with their sales and marketing staff.

That’s when they invited GK3 Capital to join this new venture.

Empowering Digital Distribution™

By outsourcing their RIA marketing program, the client empowered our team to develop an end-to-end distribution process founded on digital principles and strategies. We designed the process to overcome an array of challenges and to capitalize on the dynamics of our “digital first” world. We wanted the client’s existing sales force to make the greatest inroads possible with the new RIA audience.

We created a Digital Distribution™ program for our client. In Digital Distribution™, we bring together our years of experience on the front lines of asset management distribution with the latest and best practices in digital sales and marketing.

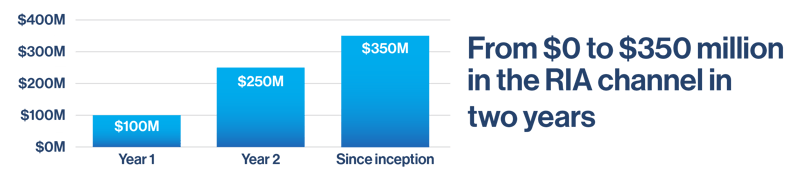

The First $100 Million

In the first year of our RIA outreach, we helped our client raise $100 million of new AUM for its strategies, despite the headwinds of the pandemic. We developed a custom Digital Distribution program in 7 steps:

1. Audit of Existing Platforms

First, we undertook a comprehensive review of the client's website, technology stack, sales process, marketing strategy, social media platforms, content, and campaigns. We determined what worked, what was needed, and what needed to be changed.

2. Content Generation

Our creative team, in partnership with the client’s marketing staff, built a robust library of articles, eBooks, videos, infographics, and blog posts. Advisors could access this library online to help educate themselves on the sponsor’s investment strategies and client solutions. This content was also used in email and digital marketing campaigns to drive inbound traffic.

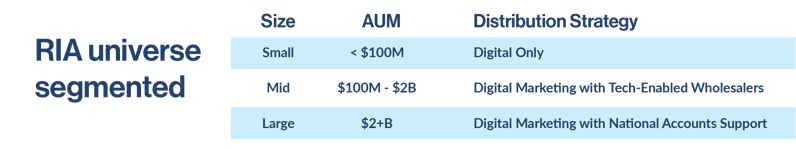

3. Segment the Target Audience

With Discovery Data, the US leader in financial industry data, we were able to build a database of over 25,000 advisors affiliated with RIAs across America for our client. We targeted advisors interested in alternative investments and segmented the RIA universe by size and distribution strategy:

With the right digital tools and systems, asset managers today can efficiently reach tens of thousands of advisors. Imagine that task without the right digital resources.

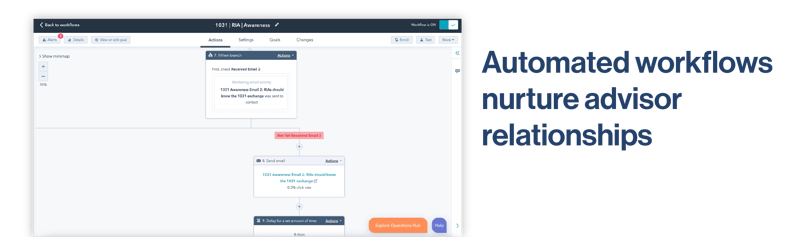

4. Introduce Automation Using Workflows

We built and implemented automated workflows to effectively nurture advisor relationships throughout their journeys of discovery. These workflows guide and track advisors’ digital interactions with online content based on their preferences.

5. Develop Due Diligence Marketplace Portal

We created a dedicated, password-protected due diligence portal exclusively for RIAs. The portal provides all the materials and information advisors need to conduct due diligence on the sponsor’s investments and strategies, review selling agreements, and download product information and offering documents. We also built the backend technology so our client could update materials and add new funds and offerings with point-and-click ease. Since its launch, over 685 advisers have enrolled on the due diligence portal.

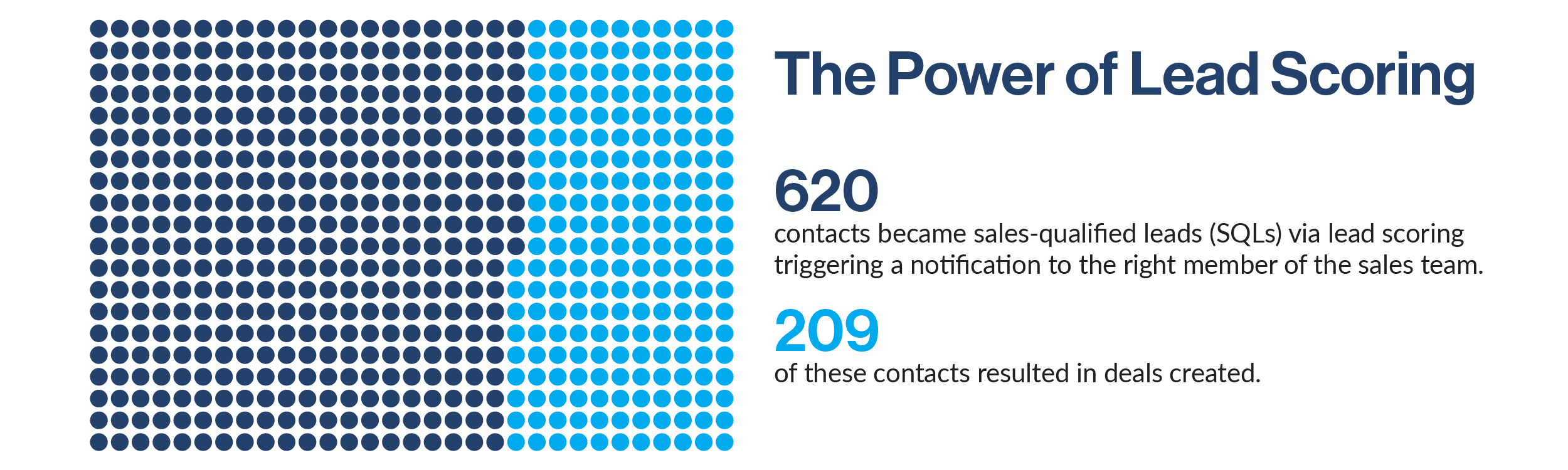

6. Implement Lead Scoring

The due diligence portal also tracked advisor activity. We converted this activity into lead scoring based on the level of an advisor’s activity and their specific product interests. These scores became real-time data for the sales team to facilitate timely outreach to the most interested advisors. In total, 620 contacts became SQLs via lead scoring, resulting in a triggered notification to the sales team member, and 209 of these contacts resulted in deals created.

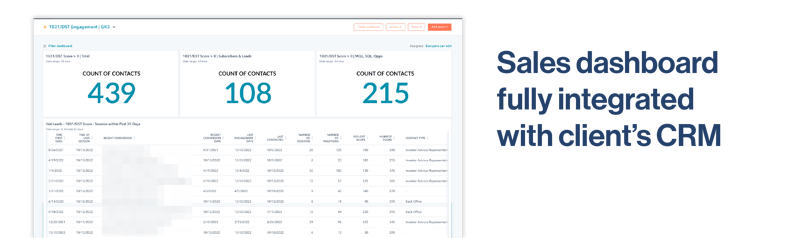

7. Develop Sales Enablement Dashboards

We built a sales dashboard that was fully integrated with the client’s CRM. The dashboard incorporated the lead scoring activity from advisors’ online activity. The dashboard provided signals to wholesalers for who to call, when to call, and what to say to the sales-qualified leads with the greatest likelihood of doing business. The process transformed the role of the sales team. The sales team is now focused on value-added consulting and service for the most interested prospective advisors. As a result, the sales team was able to sign selling agreements with 215 RIA firms.

The Next $250 Million

Our Digital Distribution™ program gained momentum over time. From $100 million in the first year of the Digital Distribution™ program to $250 million in the second year, for a total raise of $350 million. Combined with other fundraising activities, our client is now raising $2 billion per year across multiple channels.

Working closely with the client, we were able to overcome a variety of initial challenges and rapidly build a strong presence and positive profile in the RIA community. Strikingly, the cost of the program was less than the cost of one external wholesaler. The results speak for themselves.

Facing Your Own Distribution Challenge?

If you’d like to learn more about how your team can implement digital approaches to distribution, watch our short, educational video series, or schedule a free consultation here.

John Gulino is the Founder and CEO of GK3 Capital LLC. Experienced in all facets of distribution including management, direct sales, training, and development, John has been fortunate to represent some of the industry’s most respected and innovative financial institutions and has consulted with many more of the top asset management firms in the industry on how to better align their sales and marketing efforts.

Topics: