Data-Driven Marketing Insights: Ensuring Financial Services Success.

October 12th, 2023

3 min read

By John Gulino

Financial services marketing professionals operate in an industry filled with unique challenges. Limited capacity, the need to demonstrate positive ROI, and the ever-increasing expectations from sales and other stakeholder groups can create a perfect storm of pressure.

In this series, we've been exploring how data-driven strategies can turn these challenges into opportunities. Now let’s take a deeper dive into how a data-driven digital marketing methodology like Inbound can create a synergy between sales and marketing teams, helping financial services professionals like you grow AUM in this competitive landscape.

The Role of Data in Inbound Marketing

It's crucial to understand the significance of data in Inbound Marketing. Data is the lifeblood of any modern marketing strategy, and Inbound Marketing is no exception. It revolves around creating valuable content that attracts, educates, and closes your target audience. To achieve this, it's essential to know who your audience is, what they're interested in, and how they behave online.

Data is collected and analyzed at every step of the Inbound Marketing process. It begins with understanding your prospects’ interests, preferences, and pain points. This information informs content creation and distribution strategies. Data helps refine and optimize campaigns for maximum impact throughout the Inbound journey.

Creating Synergy Between Sales and Marketing

Historically, there has been a disconnection between sales and marketing teams in financial services. The often tense relationship leads to miscommunication, missed opportunities, and a lack of trust between the two functions. However, Inbound Marketing bridges this gap by sharing valuable prospect insights among the teams.

Inbound Marketing generates a wealth of prospect data that can be used to align sales and marketing efforts. This data includes information on website interactions, content downloads, email engagement, and more. Sharing this data helps build trust with sales and marketing professionals as both sides gain a deeper understanding of prospects’ behavior and preferences.

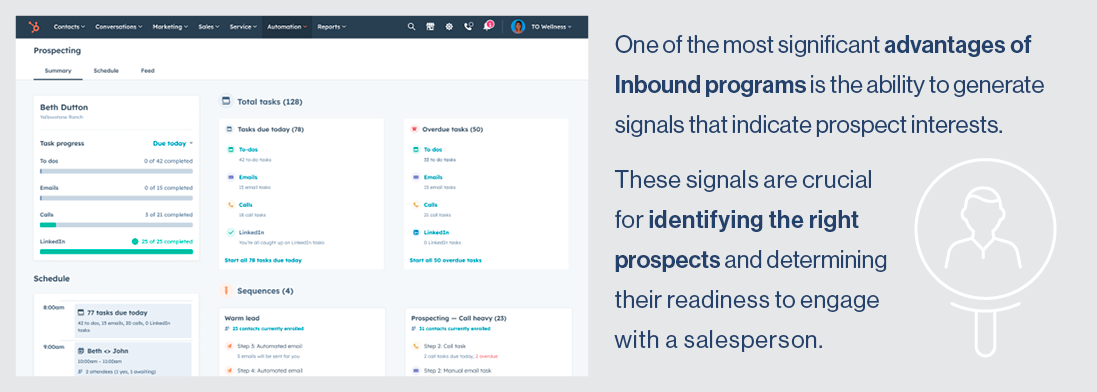

Understanding Prospect Signals

For instance, when a prospect visits your website and spends time on specific pages, it indicates a genuine interest in your services. Similarly, downloading a whitepaper or subscribing to your newsletter shows they're seeking more information. By tracking these signals, you can prioritize prospects who are further along in their journey and more likely to convert. This helps ensure your sales team focuses their efforts on the right prospects.

For instance, when a prospect visits your website and spends time on specific pages, it indicates a genuine interest in your services. Similarly, downloading a whitepaper or subscribing to your newsletter shows they're seeking more information. By tracking these signals, you can prioritize prospects who are further along in their journey and more likely to convert. This helps ensure your sales team focuses their efforts on the right prospects.

Propensity to Engage and Convert

Prospect signals reveal interests and help assess their propensity to engage with a salesperson. Timing is everything in sales; knowing when a prospect is most receptive can make all the difference.

For example, if a prospect has been consistently engaging with your content and exhibiting buying signals, it's a clear indicator that they might be ready for a sales conversation. This allows your sales team to reach out at precisely the right moment, increasing the chances of conversion.

Personalizing the Sales Approach

Data-driven insights enable personalized messaging, which is a game-changer in financial services marketing. When your sales team has access to prospect data, they can tailor their approach to address specific pain points and interests.

Personalized sales pitches and content resonate more with prospects, as they feel like you understand their unique needs and are focused solely on helping solve those needs. This level of personalization not only improves the overall customer experience but also enhances the likelihood of closing deals.

Benefits for Sales Professionals

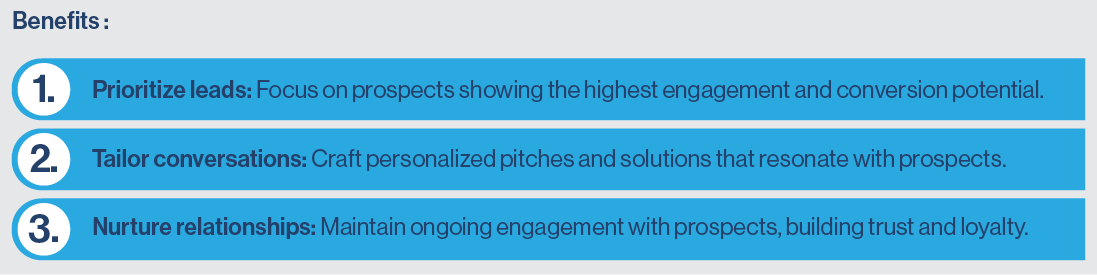

Access to prospect data isn't just beneficial for marketers; it significantly enhances sales effectiveness as well. Sales professionals armed with data-driven insights can:

Statistics show organizations that leverage data-driven strategies experience improved conversion rates and sales performance.

Statistics show organizations that leverage data-driven strategies experience improved conversion rates and sales performance.

Implementing Data-Driven Inbound Marketing

To implement data-driven Inbound Marketing successfully, financial marketing professionals often find it beneficial to work with a qualified agency. Such agencies bring expertise, tools, and resources to the table, ensuring a seamless integration of data-driven strategies into marketing plans.

Collaboration between sales and marketing teams is key to achieving success in this endeavor. Regular meetings, data sharing, and mutual goal-setting are essential to maintain synergy and drive results.

Conclusion

In the world of financial services marketing, data-driven Inbound Marketing is a game-changer. By sharing valuable prospect insights and aligning efforts between sales and marketing, asset management firms can unlock new opportunities for growth and success. Stay tuned for our next blog conversation in this important series.

And if you’d like to take a deeper dive into how data-driven marketing works, download our free inbound checklist to get started.

John Gulino is the Founder and CEO of GK3 Capital LLC. Experienced in all facets of distribution including management, direct sales, training, and development, John has been fortunate to represent some of the industry’s most respected and innovative financial institutions and has consulted with many more of the top asset management firms in the industry on how to better align their sales and marketing efforts.

Topics: