Search for topics or resources

Enter your search below and hit enter or click the search icon.

March 15th, 2022

2 min read

By John Gulino

Quick and effective? Can LinkedIn advertising generate leads, inflows, and revenues for asset managers? You may find this case study compelling.

With a year-end tax deadline approaching, one of the nation’s premier real estate investment sponsors enlisted our help to reach advisors interested in tax-advantaged strategies. The firm sought to educate advisors about the landmark tax benefits of Qualified Opportunity Zone (QOZ) investments: the ability to reduce, defer, and potentially eliminate capital gains taxes.

Advisors had a historic opportunity to help clients with sizable gains.

As you may recall, the 2017 Tax Cuts and Jobs Act created the QOZ program to spur economic development in underserved communities throughout the US. To stimulate the flow of capital into Qualified Opportunity Zones, the program enabled investors with realized gains to potentially reduce, defer and eliminate capital gains taxes by reinvesting their gains into QOZ real estate or businesses.

The tax benefit was historic, but investors had a limited time to invest.

Meeting deadlines is a key component of successful QOZ investing and funds. All QOZ investments must be made within 180 days of realizing a gain. In 2020, the IRS extended that deadline until December 31 for any investor who had a 180-day deadline from April 1, 2020 onwards.

QOZ investors and fund sponsors, including our client, faced a year-end deadline.

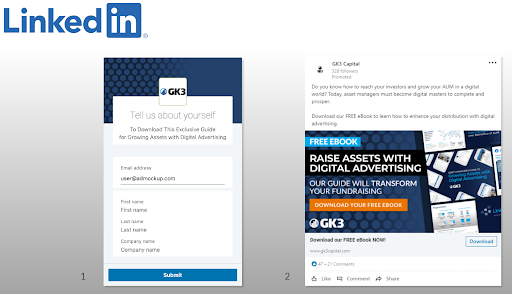

Charged with meeting the deadline, our GK3 team developed a digital advertising campaign to reach a targeted group of advisors likely to be interested in a QOZ fund for their investors. The campaign offered an informative eBook, created by GK3, highlighting the benefits of QOZ investing. Then we promoted the eBook on LinkedIn, the preferred social media platform of financial professionals.

To make the downloading process simple for advisors, we used LinkedIn's autofill form feature. Once an advisor clicked on the download request, LinkedIn automatically filled in the advisor’s name, company, and email address on the form.

As a result, our client received leads in real-time from the downloads. The sales team followed-up promptly with those advisors to help them meet the investing deadline.

A LinkedIn Ad and Autofill Download Form

The campaign generated immediate interest. Our client also got an extra quarter to market their fund when Congress extended the year-end tax deadline through the following March 31.

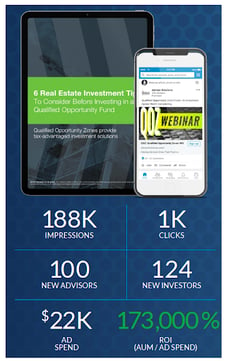

Tracking results in digital marketing is key to optimizing performance. Notable statistics for the campaign include:

Impressions = total # number of ad views in LinkedIn user newsfeeds

Clicks = total # of viewers who clicked on the ad

New Advisors = total # of new advisors who became customers of the fund sponsor

New Investors = total # number of fund investors from the new advisors

Ad Spend = total $ spent on purchasing online ads

ROI = ratio of $ raised to total $ ad spend

In the end, the LinkedIn digital ad campaign and eBook created by the GK3 Capital team helped the client raise nearly an additional $40 million for a large and successful raise.

Performance Statistics

LinkedIn Ad and eBook Campaign

The success of our client's program is illustrative. Not all campaigns pack a deadline punch. Importantly, the campaign shows how asset managers can capitalize on the digital transformation of distribution. A well-designed digital advertising plan, properly executed, can enhance your sales effectiveness.

John Gulino is the Founder and CEO of GK3 Capital LLC. Experienced in all facets of distribution including management, direct sales, training, and development, John has been fortunate to represent some of the industry’s most respected and innovative financial institutions and has consulted with many more of the top asset management firms in the industry on how to better align their sales and marketing efforts.

Topics: